Debt Payment Methods: Snowball or Avalanche, Which to Choose?

Advertisement

Managing debt effectively can feel like navigating a complicated maze, but selecting the right strategy can simplify the journey towards financial freedom. Among the various methods available, the Snowball and Avalanche approaches are two popular choices that help individuals systematically eliminate their debt. Each method caters to different psychological and financial needs, making it crucial to understand how they work.

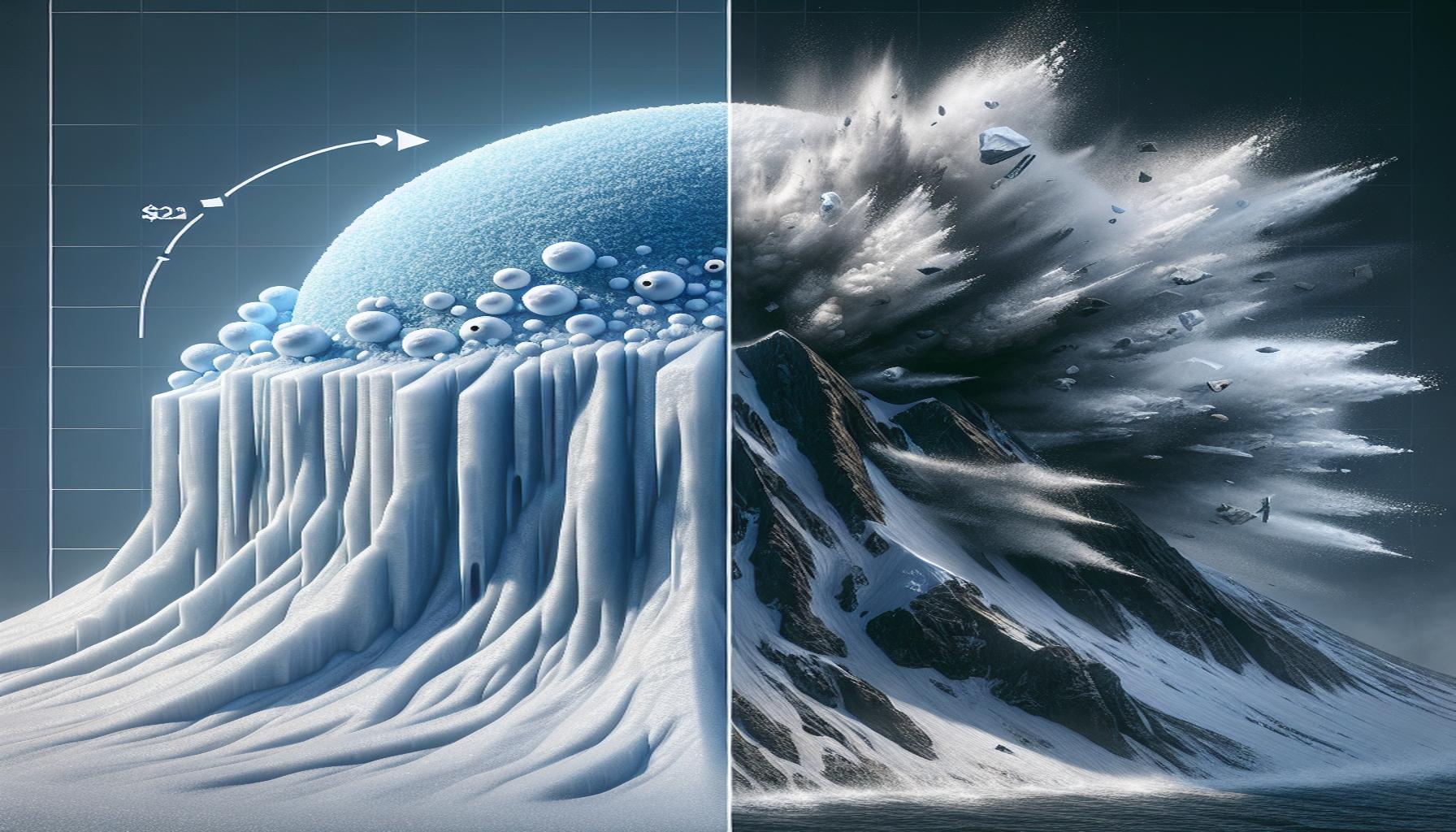

The Snowball Method

The Snowball method is grounded in the idea of achieving quick wins—encouraging individuals to focus on their smallest debts first. By targeting the smallest balance, you can eliminate that debt quickly. For example, if you have three debts of $200, $600, and $1,000, you would start by paying off the $200 debt. Once it’s gone, you gain a sense of accomplishment and motivation to tackle the next smallest debt.

Advertisement

- Focus on small debts: By concentrating on smaller balances, you increase your confidence and propel yourself toward the larger debts.

- Boosts motivation: The psychological benefit of paying off debts quickly cannot be understated; it instills a sense of achievement which can be a powerful motivator.

- Payments snowball: With each debt eliminated, the funds used for those payments can be redirected towards subsequent debts, creating a ‘snowball’ effect that accelerates your progress.

The Avalanche Method

In contrast, the Avalanche method prioritizes financial efficiency by focusing on debts with the highest interest rates first. This approach aims to minimize the total interest paid over time. Suppose you have debts of $1,000 at 20% interest, $600 at 15%, and $200 at 5%. Using the Avalanche method, you would focus on paying off the $1,000 debt first because it has the highest interest that compounds over time.

- Focus on high interest: By targeting high-interest debts, you reduce the overall cost of borrowing, ultimately leading to financial savings.

- Saves money: This method can save you a significant amount on interest payments, making it a financially savvy choice for many individuals.

- Longer payoff time: While you may not see immediate results like with the Snowball method, the long-term benefits of paying off high-interest debts can greatly outweigh the quicker wins.

Each method has distinct advantages, so it’s essential to reflect on your personal financial situation and psychological tendencies when making a choice. If you thrive on quick victories that keep your motivation levels high, then the Snowball method might be your best fit. However, if you’re more financially driven and want to minimize the cost of borrowing, then the Avalanche method could lead you to more significant savings in the long run. Understanding these strategies is the first step in forming a personalized plan to conquer your debt and set yourself on a successful path toward financial stability.

Advertisement

CHECK OUT: Click here to explore more

Choosing the Right Method for You

When it comes to tackling debt, understanding the fundamentals of both the Snowball and Avalanche methods is crucial in determining which strategy aligns best with your financial habits and goals. While both methods aim to eliminate debt, they do so through distinctly different approaches, each offering unique benefits and considerations.

The Snowball Method: Quick Wins for Enhanced Motivation

The Snowball method is especially appealing for those who thrive on recognition of small achievements. This approach begins by identifying your smallest debt and committing to pay it off first, regardless of the interest rate. By narrowing your focus to this initial, more manageable amount, you’re more likely to experience a sense of accomplishment that fuels your drive to continue paying down debt.

For instance, if your debts total $1,500 split into three amounts—$300, $600, and $900—the Snowball method encourages you to prioritize the $300 debt. Once that debt is cleared, you can redirect the money you were using for those payments towards your next smallest debt of $600. This strategy not only instills a sense of achievement but also creates a rhythm of success as you continue to tackle bigger debts.

- Focus on small debts: By prioritizing smaller balances, you are likely to see quicker results, which boosts your confidence.

- Improves motivation: Each eliminated debt acts as a motivational stepping stone, encouraging you to stick to your repayment plan.

- Creates momentum: The funds freed from paid-off debts can be reallocated to subsequent debts, resulting in increasingly larger payments that expedite your journey to being debt-free.

The Avalanche Method: Smart Financial Planning

On the other hand, the Avalanche method approaches debt repayment from a financial efficiency standpoint. This strategy emphasizes paying off debts with the highest interest rates first, enabling you to save money in the long run. For individuals who are more financially oriented and able to resist the immediate gratifications of satisfying smaller debts, the Avalanche method proves to be an effective approach.

Imagine you have three debts: $1,200 at 18% interest, $800 at 10% interest, and $500 at 5%. The Avalanche method dictates you focus your efforts on the $1,200 debt first, as it incurs the most interest. While this may mean fewer initial wins, the long-term benefits include reduced overall interest payments and a significant decrease in the total time it takes to pay off your debt.

- Target high-interest debts first: This focus allows you to minimize the total amount paid over time.

- Save on interest costs: The long-term nature of this approach can lead to substantial savings, making it an appealing choice for those looking to manage their finances effectively.

- Requires patience: Progress might appear to be slow at first, as larger debts take longer to pay off, but the eventual financial relief is worth the effort.

Both methods have their merits, and it’s essential to choose the one that resonates with your personal circumstances and psychological tendencies. Assessing how you handle motivation and financial numbers will guide your decision, ensuring you remain engaged and proactive in your journey towards debt freedom.

CHECK OUT: Click here to explore more

Understanding the Impact of Your Financial Situation

Choosing between the Snowball and Avalanche methods also requires a clear understanding of your personal financial situation. Recognizing factors such as your income stability, existing budget, and the types of debt you carry can play a significant role in guiding your choice. This section will delve into considerations that help identify which method may be more effective for you.

Your Lifestyle and Spending Habits

The first critical factor to evaluate is your lifestyle and spending habits. If you are a person who finds it challenging to stay motivated when facing larger, more daunting debts, the Snowball method may be ideal for you. As mentioned earlier, paying off smaller debts can provide you with quick victories that help to build momentum towards larger financial goals.

For example, if you find yourself frequently distracted by new expenses, having cleared smaller debts may make you feel financially lighter and more confident in your ability to stay on top of future obligations. Keeping your motivation high is key in this journey.

- Assess your motivation: Determine how much motivation you will need to maintain your focus and commitment throughout the repayment process.

- Evaluate your expense behavior: Identify whether you tend to overspend in certain areas and create a budget that helps mitigate those overspending tendencies.

Your Financial Goals and Time Frame

Another crucial aspect to consider is your financial goals and the timeframe in which you wish to settle your debts. If your primary concern is to become debt-free as quickly as possible and save money on interest, the Avalanche method is likely your best bet. This approach requires a clear understanding of the interest rates associated with each debt, which can help in determining a repayment priority that aligns with your overall financial objectives.

Let’s say you aim to improve your credit score significantly within the next year. By using the Avalanche method to pay off high-interest debts, you can lower your credit utilization ratio more effectively, which is an important factor for credit scoring. As a result, your credit score improves faster, benefiting your future financial endeavors.

- Set clear financial goals: Determine whether your priority is to reduce the total interest paid or achieve quick wins.

- Align your strategy with your timeline: Consider how quickly you want to see progress in your journey and how that fits with your long-term financial plans.

Analyzing Your Types of Debt

The nature of your debts also plays an essential role in determining which repayment method is most advantageous. For instance, if you carry several high-interest credit cards, the Avalanche method’s emphasis on interest could help you save significantly over time. Conversely, if your debts are more balanced across the board with no outstanding interest discrepancies, then the Snowball method’s motivational aspect may take precedence.

It’s also important to examine factors like loan terms and potential penalties for early payment, which could influence whether the Avalanche method or the Snowball method is most beneficial. For instance, some student loans may have unique repayment features, and analyzing those terms should be part of your debt repayment strategy.

- List all your debts: Consider not just the amounts but also the interest rates and repayment terms.

- Identify any specific terms or conditions: This may include penalties for early repayment or differing payment timelines that could affect your choice.

Ultimately, understanding your financial situation and habits is paramount when choosing between the Snowball and Avalanche methods. By grasping these metrics, you can make a more informed decision that aligns with your motivations and financial goals, setting you on the right path toward becoming debt-free.

SEE ALSO: Click here to read another article

Conclusion

Ultimately, deciding between the Snowball and Avalanche methods for debt repayment is a highly personal journey that requires careful consideration of your unique financial circumstances. Each method has its merits, and there is no one-size-fits-all solution. The Snowball method appeals to those who thrive on quick wins and need motivation to keep moving forward, while the Avalanche method is more suited for individuals focused on minimizing interest payments and reducing debt in a financially efficient manner.

It’s important to self-reflect on your spending habits, financial goals, and the types of debt you carry. For instance, if you struggle with motivation and find small successes essential for maintaining momentum, the Snowball strategy may be your best option. However, if you aim to decrease your overall interest payments and see significant progress in terms of savings on loan repayment, the Avalanche method could align better with your goals.

Additionally, consider the timeliness of your financial objectives. Whether you aspire to clear your debts quickly or prefer a structured, methodical approach affects which method you should choose. It can also be beneficial to remain flexible and adjust your strategy if circumstances, such as interest rates or financial goals, change over time.

By being informed and strategic about your choice between these two methods, you can pave a clearer path towards financial freedom. Remember, the best approach is one that resonates with your personal preferences and motivates you to take action!