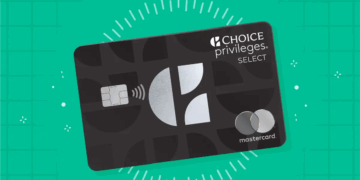

Easy Guide Apply for Choice Privileges Select Mastercard Credit Card

Unlock a world of exciting rewards and seamless travel experiences with the Choice Privileges Select Mastercard Credit Card. This versatile credit card is designed for those who love to explore and want to make the most out of their purchases. With a host of intriguing perks, it’s more than just a card; it’s a gateway […]

How to Apply for Emirates Skywards Premium World Elite Mastercard Benefits

Unlock a world of luxury and exclusive rewards with the Emirates Skywards Premium World Elite Mastercard. Designed for frequent travelers, this credit card offers a plethora of benefits like earning Skywards Miles on every purchase and gaining access to over 1,000 airport lounges worldwide. Whether you’re jet-setting across continents or dining at home, this card […]

How to Apply for Delta SkyMiles Platinum American Express Credit Card

Discover the Delta SkyMiles Platinum American Express Credit Card Unlock a world of travel benefits with the Delta SkyMiles Platinum American Express Credit Card. This card is meticulously designed for frequent flyers, offering a suite of incredible perks that extend far beyond typical credit card rewards. Dive into the advantages tailored for those with an […]

How to Apply for the M1 Owners Rewards Credit Card Step-by-Step Guide

Exploring Innovative Financial Solutions Embarking on a journey through the landscape of contemporary financial solutions? Consider an option that stands out for its unique benefits and potential for financial growth: the M1 Owner’s Rewards Credit Card. This isn’t just another card to stash in your wallet; it’s a conduit to exclusive benefits and financial advancement. […]

Steps to Create a Financial Plan that Combines Budgeting, Saving, and Investing

Creating a comprehensive financial plan involves combining budgeting, saving, and investing. By assessing your current finances, setting clear goals, and regularly monitoring your progress, you can establish a solid foundation for financial stability and growth, ultimately leading to a secure financial future.

How to Plan Your Finances for Major Events like Weddings or Moves

Navigating major life events like weddings or moves requires careful financial planning. The article emphasizes the importance of creating a detailed budget, prioritizing expenses, and preparing for unexpected costs. It also suggests utilizing cost-saving strategies and technology to manage finances effectively, ensuring a stress-free and enjoyable experience.

Strategies to Save on Subscriptions and Monthly Services

This article offers practical strategies for managing and reducing expenses associated with subscription services. It emphasizes evaluating usage, leveraging discounts, and utilizing bundling options, while encouraging mindful budgeting and proactive renewal management. By adopting these techniques, readers can enjoy their subscriptions without overspending.

How to Set and Track Financial Goals Using Free Apps

Setting financial goals is essential for achieving stability and success. Free apps simplify this process by providing user-friendly interfaces, real-time tracking, and customizable features. By utilizing these tools, individuals can effectively manage their finances and transform aspirations into attainable objectives, fostering accountability and informed decision-making.

Tips for Transforming Financial Habits and Spending More Consciously

Learn to transform your financial habits by understanding spending triggers, creating a purposeful budget, and embracing mindful spending. Regularly track expenses and adjust your budget to align with your goals. Adopting a continuous learning mindset empowers you to make informed choices, leading to financial stability and peace of mind.

How to renegotiate debts and achieve better payment terms

Debt management involves renegotiating terms with creditors for better conditions. Key strategies include assessing your financial situation, prioritizing debts, researching relief options, and communicating openly with creditors. Preparation, transparency, and effective follow-up are crucial for successful negotiations, helping you achieve financial stability and build healthier spending habits.